The Best Guide To Pvm Accounting

The Best Guide To Pvm Accounting

Blog Article

Rumored Buzz on Pvm Accounting

Table of ContentsThe Only Guide to Pvm AccountingExamine This Report about Pvm AccountingWhat Does Pvm Accounting Mean?Some Known Facts About Pvm Accounting.Not known Incorrect Statements About Pvm Accounting Everything about Pvm Accounting

Make sure that the accountancy process complies with the regulation. Apply needed building bookkeeping standards and treatments to the recording and coverage of construction activity.Understand and maintain common cost codes in the accounting system. Interact with numerous funding firms (i.e. Title Company, Escrow Firm) relating to the pay application procedure and needs required for payment. Manage lien waiver dispensation and collection - https://www.huntingnet.com/forum/members/pvmaccount1ng.html. Display and fix financial institution problems consisting of fee anomalies and examine differences. Assist with applying and maintaining inner economic controls and treatments.

The above statements are intended to explain the general nature and degree of job being done by people designated to this category. They are not to be interpreted as an extensive listing of responsibilities, tasks, and abilities needed. Employees might be needed to execute tasks beyond their normal responsibilities from time to time, as required.

The 25-Second Trick For Pvm Accounting

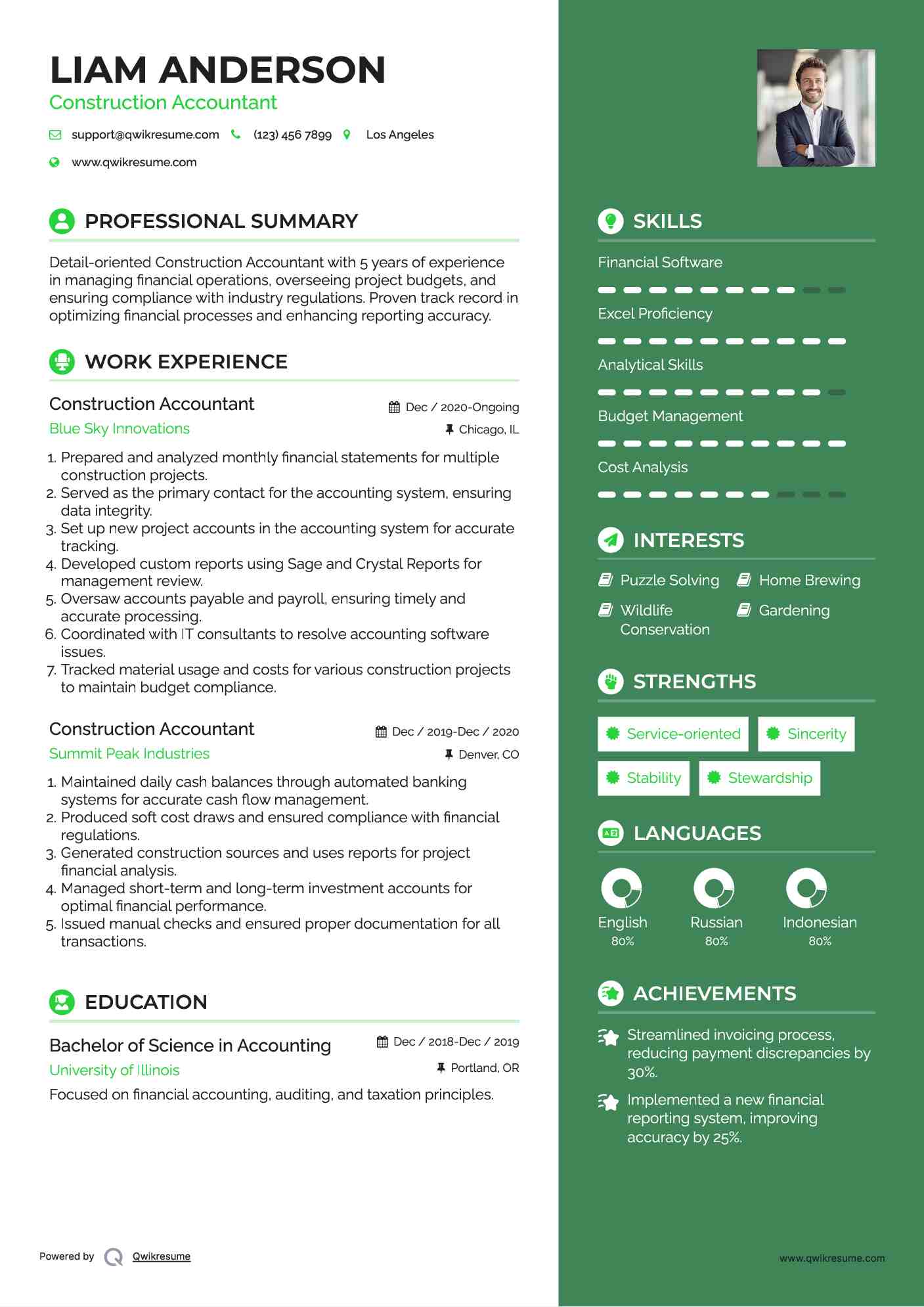

You will certainly help support the Accel team to make sure distribution of successful in a timely manner, on spending plan, jobs. Accel is seeking a Construction Accounting professional for the Chicago Workplace. The Construction Accounting professional does a range of accountancy, insurance policy conformity, and job administration. Functions both independently and within specific divisions to preserve economic records and make particular that all records are maintained current.

Principal duties include, yet are not limited to, handling all accounting functions of the business in a prompt and accurate fashion and supplying reports and schedules to the company's certified public accountant Company in the prep work of all economic declarations. Guarantees that all audit procedures and features are taken care of accurately. Responsible for all monetary documents, payroll, financial and everyday procedure of the accountancy function.

Works with Job Supervisors to prepare and upload all month-to-month billings. Produces monthly Job Price to Date records and functioning with PMs to integrate with Task Managers' budget plans for each job.

Some Known Incorrect Statements About Pvm Accounting

Effectiveness in Sage 300 Construction and Property (previously Sage Timberline Office) and Procore construction monitoring software program a plus. https://canvas.instructure.com/eportfolios/2921746/Home/Navigating_the_Maze_of_Construction_Accounting_A_Comprehensive_Guide. Must also be proficient in various other computer system software program systems for the prep work of records, spreadsheets and various other audit evaluation that may be called for by administration. financial reports. Need to have strong organizational skills and capability to prioritize

They are the financial custodians that guarantee that building projects continue to be on budget plan, follow tax obligation laws, and keep economic openness. Construction accounting professionals are not just number crunchers; they are tactical companions in the construction procedure. Their primary duty is to handle the monetary facets of building projects, ensuring that resources are allocated efficiently and monetary risks are decreased.

Facts About Pvm Accounting Uncovered

They work carefully with project managers to create and monitor budgets, track expenses, and projection monetary requirements. By maintaining a tight grip on project finances, accounting professionals help stop overspending and financial troubles. Budgeting is a cornerstone of effective building and construction jobs, and building and construction accounting professionals contribute in this regard. They develop detailed spending plans that include all project costs, from products and labor to permits and insurance.

Building and construction accountants are skilled in these policies and ensure that the job conforms with all tax demands. To stand out in the role of a construction accounting professional, individuals need a strong instructional structure in accountancy and money.

Additionally, qualifications such as State-licensed accountant (CPA) or Certified Building And Construction Sector Financial Expert (CCIFP) are very concerned in the industry. Working as an accounting professional in the construction industry includes an one-of-a-kind set of challenges. Building and construction projects usually include limited target dates, altering laws, and unexpected expenses. Accounting professionals have to adapt rapidly to these obstacles to maintain the job's monetary health and wellness undamaged.

Facts About Pvm Accounting Revealed

Specialist accreditations like certified public accountant or CCIFP are also extremely recommended to demonstrate experience in construction bookkeeping. Ans: Building accountants create and monitor spending plans, recognizing cost-saving opportunities and ensuring that the task remains within spending plan. They likewise track costs and forecast economic demands to stop overspending. Ans: Yes, building accounting professionals take care of tax conformity for building projects.

Introduction to Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business need to make tough options among many monetary options, like bidding process on one job over an additional, selecting funding for materials or devices, or more setting a project's revenue margin. Construction is an infamously unpredictable sector with a high failure price, slow-moving time to payment, and inconsistent money circulation.

Production entails repeated processes with easily identifiable prices. Manufacturing needs various procedures, products, and tools with varying costs. Each job takes location in a brand-new area with differing website conditions and special obstacles.

The Definitive Guide for Pvm Accounting

Resilient connections with suppliers relieve negotiations and boost effectiveness. Inconsistent. Regular usage of different specialized service providers and vendors impacts effectiveness and cash money circulation. No retainage. Settlement shows up in full or with normal settlements for the full contract amount. Retainage. Some section of repayment may be held back up until project conclusion also when the specialist's job is finished.

Normal production and short-term contracts cause workable capital cycles. Uneven. Retainage, sluggish repayments, and high in advance prices bring about long, irregular capital cycles - Clean-up accounting. While traditional makers have the advantage of regulated environments and enhanced manufacturing processes, building and construction companies need to continuously adapt to each brand-new job. Even somewhat repeatable tasks require adjustments as a result of site problems and other elements.

Report this page